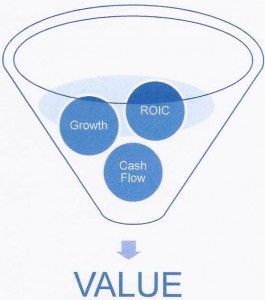

A CONCEPT OF VALUE

Koller, Dobbs, and Huyett contend that a business’s value is driven by its growth, return on capital, and resulting cash flows; that value is created when companies generate higher cash flows; and that value depends on who is managing the business and the strategy pursued.1

CONNECTING VALUE TO PAYMENTS ACCEPTANCE

One significant way business leaders and managers can increase business value is to implement and promote acceptance of electronic payments—specifically, acceptance of electronic checks and corporate payment cards.

Acceptance of electronic payments can: 1) increase the average purchase amount of individual orders, 2) increase total transaction dollar volume, and 3) increase the total number of sales for any given time period, by facilitating greater purchasing power for those buyers who can effectively combine budgeted card payment spending with allocated corporate cash. It facilitates your customers’ corporate card programs and efforts to modernize their accounts payable departments.

Electronic payments acceptance can improve your return on invested capital by reducing collections, automating payments procedures, simplifying your accounts receivable processes, and facilitating integration with other enterprise systems.

A CALL TO ACTION

Some firms are delaying implementation of electronic payments acceptance because they view acceptance of paper checks as tried-and-true, while others—not wishing to go the way of the Polaroid camera nor, more recently, the personal computer—are realizing this is an opportune time to gain competitive advantage by improving customer service and updating internal procedures.

How do you value your enterprise?

1 Tim Koller, Richard Dobbs & Bill Huyett,Value: The Four Cornerstones of Corporate Finance, (New Jersey: Wiley & Sons, 2011)